Table of Content

- Which states have the cheapest homeowners insurance cost?

- Average Homeowners Insurance Costs In Georgia

- Most & least expensive zip codes for homeowners insurance in California

- How much is homeowners insurance for a $300,000 house in Atlanta

- What is the average range for homeowners insurance in Atlanta with a house valued at $200k?

- Getting Online Homeowners Insurance Quotes in Atlanta

The average cost of insurance for homeowners with good credit is $3,855 per year, while the average rate for those with poor credit scores is $6,624. Having higher deductibles for your homeowners insurance in Atlanta can lessen the cost of your annual premiums. Your deductible refers to the money that you pay out of pocket if you make a claim. There are different factors that can affect the cost of your homeowners insurance premium. The best way to know is to get a complete Atlanta home insurance quote. Nevertheless, most insurance companies rely on common factors to determine the final cost of your premiums.

Senior Consumer Analyst Penny Gusner suggests getting at least three price quotes when shopping for coverage, and says that doing so can save you up to hundreds of dollars annually. You choose a home insurance deductible amount, which applies to claims for damage to your home or belongings, but not if you’re sued or a medical claim is filed by someone injured in your home. These are typically in the amounts of $500, $1,000, $1,500, $2,000 and $2,500.

Which states have the cheapest homeowners insurance cost?

Based on Insurance.com’s rate analysis, on average the home insurance cost in Texas is $4,142. Texas is counted among the states with the highest homeowners insurance rates. Homeowners in Oklahoma pay the highest insurance rates for $200,000 dwelling coverage. In comparison, the cost of home insurance is the lowest in Hawaii, at $440 a year for the same coverage limits.

Atlanta homeowners with a standard policy and $1,000 deductible typically pay $3,855 per year. Those with a similar policy but a $2,000 deductible pay an average of $3,483. If your Atlanta home is newly built, you may have cheaper insurance rates than those who own older houses. Modern materials are more resistant to damage and are easier to replace. Deductibles – As detailed above, the amount that you agree to pay before the insurance company will process your claim will also have an overall effect on the cost of your premium. Living near a full-time fire station with a nearby hydrant plays a role in your home insurance rates.

Average Homeowners Insurance Costs In Georgia

The state is ranked at number 20 in the entire country with an annual average homeowners insurance cost of $1,200. With the national average at $1,192 per year, the state is able to maintain affordable premiums compared to their neighboring state, Florida. Using our home insurance calculator below, you can compare average home insurance rates by ZIP code for 10 different coverage levels.

For more information on how home insurance rates are determined, review some of the main factors affecting your home insurance rate. You can also use the home insurance calculator below to see what average rates are in your neighborhood. Most home insurance policies come with $100,000 in personal liability insurance but this is rarely enough coverage. The cost to defend a lawsuit or to pay for medical expenses for a serious injury can easily exceed that amount. Insurance.com’s analysis of 2022 rates found the highest homeowners insurance rates in ZIP code 77471, Rosenberg, Texas.

Most & least expensive zip codes for homeowners insurance in California

Choosing a higher deductible, making sure you get all the discounts that you can and not filing too many claims can also ensure you get the cheapest home insurance. Homeowners insurance rates are impacted by age and size of the home, claim history, cost of construction materials, and also by location. Read on to compare home insurance rates by insurance company, state – even down to ZIP code – and find out what you can expect to pay for the coverage you need.

Because costs are not uniform, it's crucial to shop around for the best home insurance rate. Barry says that most insurers recommend a deductible of at least $500, which may be ok for you. But keep in mind that by raising that to $1,000, you're likely to save as much as 25% on your policy, according to the III. Of course, that's $1,000 out of your pocket if there are major problems, so it's a bit of a balancing act. If your home is insured for $200,000 and your deductible is 2%, you will owe $4,000 before insurance coverage kicks in.

How much is homeowners insurance for a $300,000 house in Atlanta

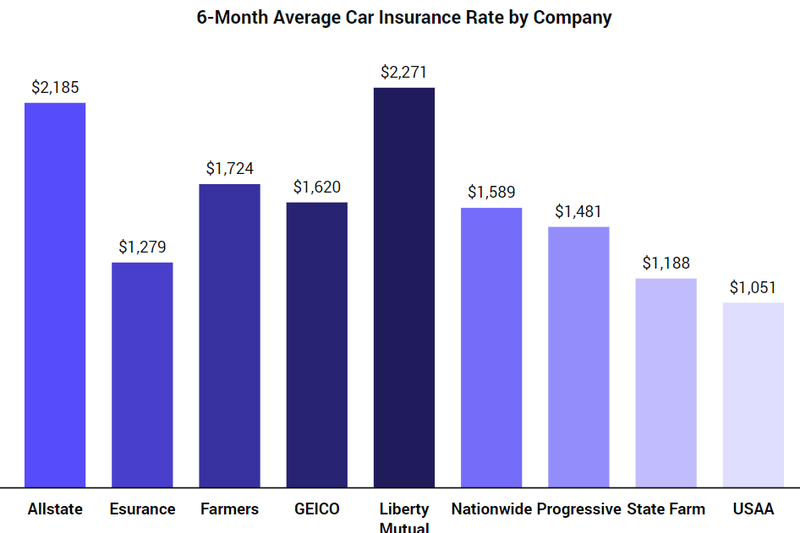

Allstate, Nationwide and USAA also had cheap insurance rates for Georgia homeowners, compared to the other companies. Here are home insurance rates by company for six coverage sets, all with a $1,000 deductible. Credit Score – Credit scores can greatly affect your insurance premium cost because most companies consider poor credit scores as high risk. Take care of your credit score to enjoy better homeowners insurance rates.

You don’t want it to be so high that it would be unfeasible to pay if you have a claim. The average discount for deadbolts or burglar alarms alone on a house with $300,000 in dwelling coverage is relatively low. This means you’re not likely to see big rate savings if your house has these features and nothing else. With an average discount of $100, smoke alarms provide a slightly larger discount for Atlanta area homeowners. These areas and neighborhoods pay the highest home insurance rates across Atlanta.

One part of a state might have higher rates because there is more crime. Or another part of the state may have lower rates because severe weather losses are less frequent. Note that the dollar differences in parenthesis are those that are greater than the national average.

Remember that the ultimate goal of any insurance company is to receive as much in premiums as possible and payout as little as possible in claims. According to a rate analysis by Insure.com, homeowners in Atlanta pay an average of $1,545 per year for a $300,000 house. These rates are for the coverage limits of $100,000 for liability protection and $1000 deductible. The average cost of homeowners insurance in Atlanta, NY is $1,118 annually for the dwelling coverage of $200,000 and the liability protection of $100,000. The amount you pay for home insurance each year depends on many different things.

Policygenius analyzed thousands of quotes from the 5 largest Atlanta insurers to find the average cost of homeowners insurance with each company in 2022. Power customer satisfaction scores and compared that with the coverage needs of Atlanta residents to find the best homeowners insurance in Atlanta. Atlanta is a traditional southern state with a rich and varied history, and it pairs that with the progress of the future.

Although the national average rate for home insurance is $2,777, the cost varies by coverage levels and location. Homeowners insurance is most expensive in Oklahoma at $5,317 a year and cheapest in Hawaii at $582 a year. The more claims that you’ve filed, the higher a risk you are to an insurance company. The claims history of homes in your area could also play a part in your rates, as they show the insurance company how high a risk your area is for things like burglary. Your credit score can have an impact on your home insurance rates because insurance companies see your credit score as an indicator of risk. Standard insurance policies don't often include flood insurance, it's a good idea to include it as an add-on coverage.

The reason for getting the police involved is the investigation conducted by a law enforcement agency represents the official version of events. Your insurance company refers to the detailed description of the incident that caused damage to your house. Contacting a law enforcement agency is especially important if the damage done to your home was the result of a crime or natural disaster.

You should also consider streamlining the heating system, electrical system, and plumbing in order to lower the possibility of fire and water damage. Nearly all states allow insurers to consider a person's credit history. You'll want to get enough coverage on your policy to cover the full cost of rebuilding your home if it gets destroyed due to a covered peril. As you take these and other steps, you'll have a much better chance of finding the right coverage for your home at the best price available to you. Head over to Credible, who has partners to give you a free insurance quote within minutes. Insurance companies determine and interpret risk differently, which is why you may get different quotes from different companies.

No comments:

Post a Comment